Liquidity Provision

Full-cycle market making and liquidity management services based on cutting-edge algorithmic technologies and in-depth experience working with crypto projects on trading platforms

Mission

We build a healthy crypto market and bring sustainable growth to crypto projects by providing liquidity management services at all stages of a project lifecycle

Metrics of

successful liquidity management

Our offers

Innovations

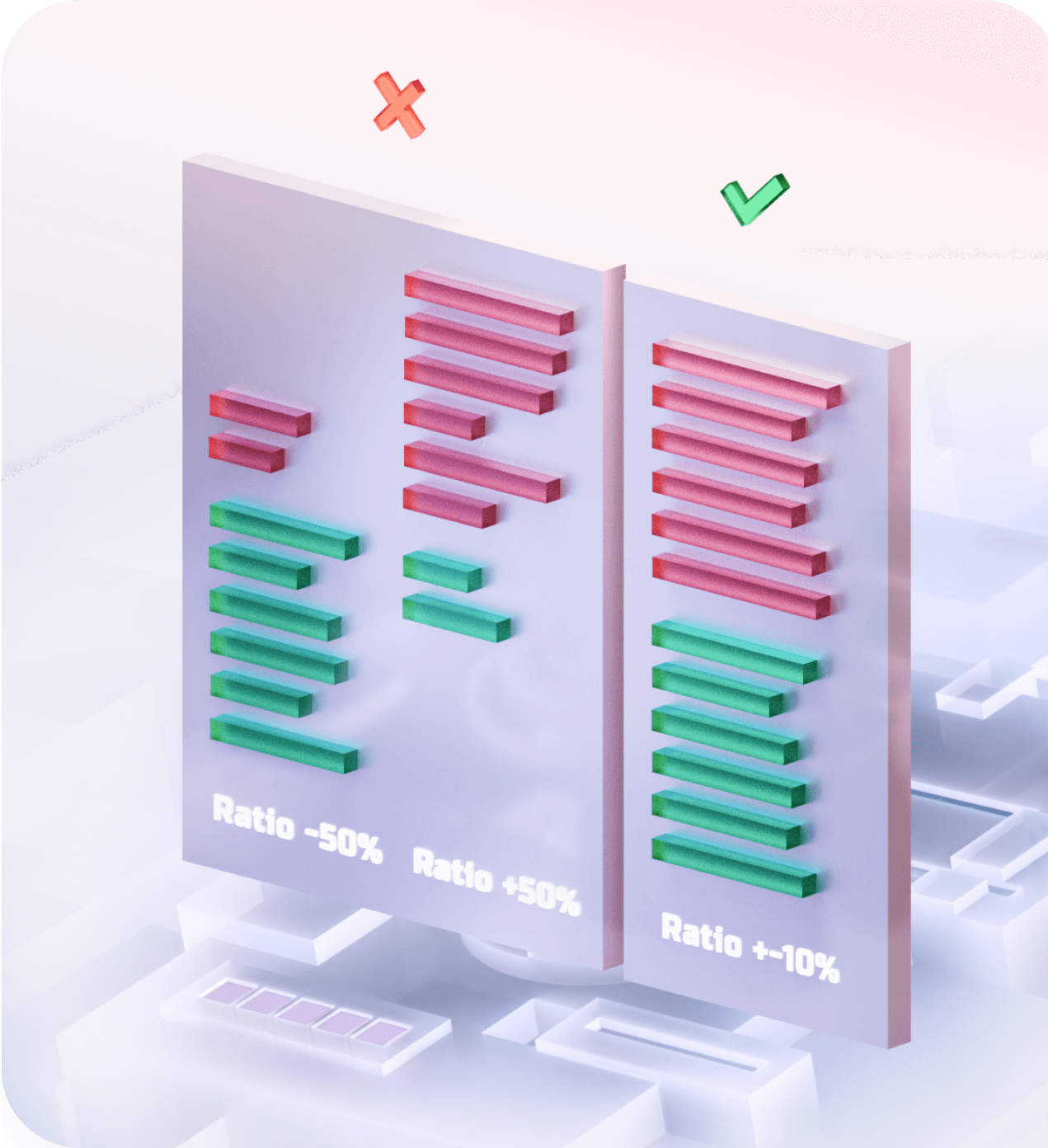

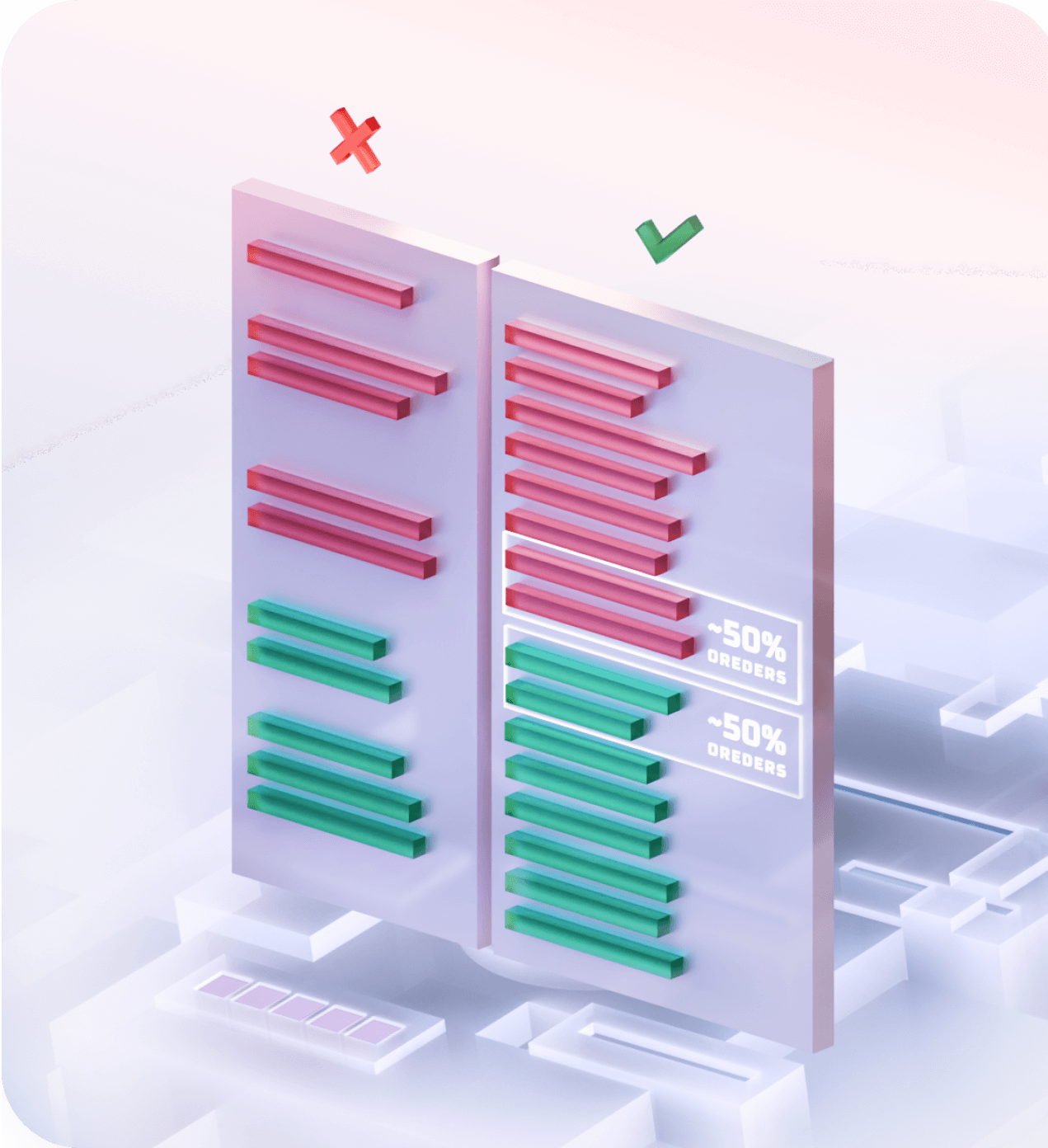

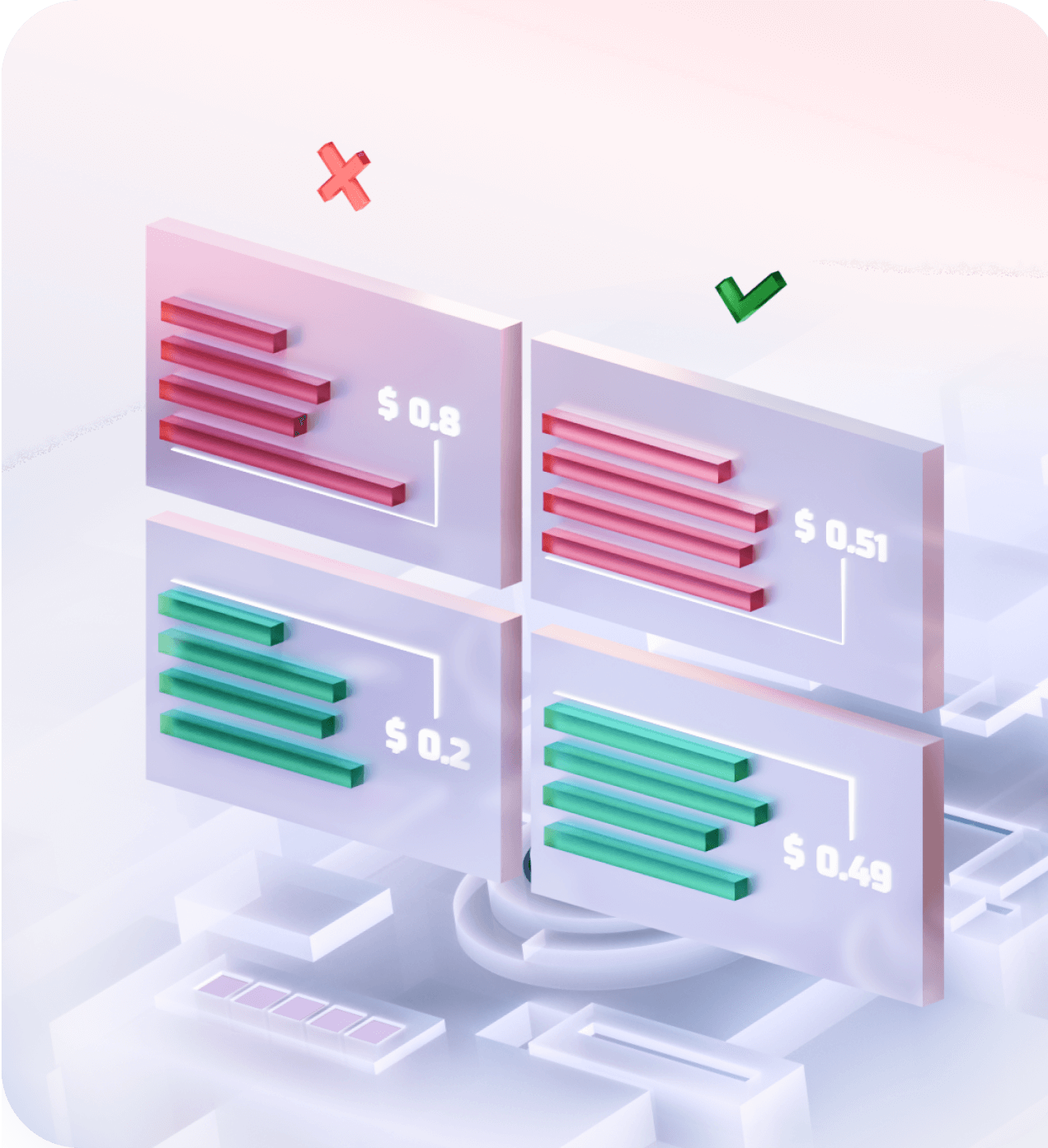

Be sure of accurate and timely implementation of the liquidity provision strategy. Our algorithms’ performance guarantees predictable results and often even exceeds expectations. 1000 orders are never a problem for us!

Transparency

Keep an eye on your token liquidity by getting regular reports on trading activities and current market conditions to make the right decisions and boost the development of your project

Personalization

An outstanding project requires a custom-tailored solution. We provide first-class support service—your personal manager is always here and ready to help you. Take your seat and enjoy the flight. That’s the level of liquidity management services you deserve

Stability

We provide non-stop service 24/7. Our engineers constantly monitor processes and are always ready to handle any possible issue quickly. That’s why our service is prepared to ensure you the trading provision of liquidity

Security

The Liquidlines software can prevent any security issues. We do not request direct access to your exchange account. All our services are based on a secure and reliable API connection

Connect us to your needs

Tell us about your token, project, goals, and dreams. We are here to create a valuable brief for you and your team to show a complete picture of your project liquidity needs

Get a relevant offer

A dedicated liquidity expert prepares a custom offer based on your crypto project's advantages, development strategy, and market analytics. We explain how we can solve your liquidity tasks and the value it brings to your project

Control the process

All the liquidity management processes are fully transparent - watch the indicators of your project get higher, and traders become more active

Valuable presentation of the result

We prepare an informative report on each milestone of our cooperation and present it to you. Get unique insights based on your crypto token’s progress and current market state